Investing in AIM shares certainly has its risks. The listed stocks tend to be much younger in their business cycle and thus are exposed to many additional threats. But that also means there’s an enormous amount of room to grow if the company succeeds. I’ve spotted one tech stock that I think looks primed to explode. And what’s more, the price seems incredibly cheap to me. Should I add it to my portfolio? Let’s take a look.

A tech stock with recurring revenue

Craneware (LSE:CRW) is a software-as-a-service (SaaS) business that collaborates with US hospitals and other healthcare providers. Using its platform clients can quickly identify the true underlying costs of treating specific patients. Simultaneously, it also exposes any inefficiencies that once removed, lead to margin improvement.

As a result, hospitals can manage patient billings and expenses more effectively while also further mitigating any compliance risks.

The platform is a modular system that has 17 different solutions. Clients pay to access the modules they need through fixed contracts that typically span three to nine years. Needless to say, that’s quite a financial commitment, so it’s very reassuring to see that contract renewals are on the rise.

The fact that clients are willing to renew a contract for up to nine years indicates that the platform has become an essential tool, granting Craneware substantial pricing power. At least that’s what I think.

The risks of investing in AIM shares can be high

As previously stated, AIM shares are already exposed to a higher risk level than other listed stocks. And Craneware has the additional challenge of navigating one of the most highly regulated industries in the world – the healthcare sector.

The tech stock’s platform is still subject to patient care regulations as it is indirectly involved with health centres’ day-to-day operations. These restrictions do create barriers to entry for rival firms. But there are already other companies that offer similar services. Any breach could have a significant impact on the firm’s reputation that would undermine its strong pricing power and likely lead to client loss.

Another threat comes in the form of cyberattacks. The data being used on Craneware’s platform is especially sensitive (patient files, medical histories, insurance policies). Any breach in security that exposes personal data could also hurt its reputation and could lead to a rapid decline in contract renewals.

A cheap tech stock in hiding

The stock’s P/E ratio today is nearly 50. That’s hardly what I would call cheap. But a closer inspection reveals a different picture.

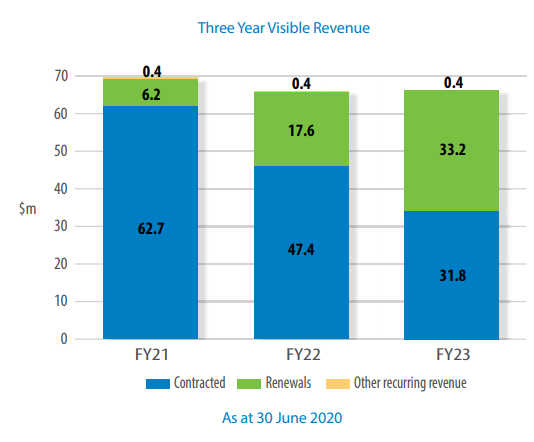

When a client pays upfront, Craneware doesn’t recognise the revenue in a single chunk. Instead, it is broken up and recorded over the length of the contract. The income statement for 2020 reported that total revenue was $71.5m. But there is an additional $200m that will be earned from existing clients, and new planned subscriptions over the next three years.

Source: Craneware Annual Report 2020

With a net profit margin of 24%, if we include the additional $200m revenue, that would indicate a total profit for 2020 of $65m. At today’s price, this places the P/E ratio at 9. Now that looks like a cheap tech stock that I’d want in my own portfolio even with the added risk from AIM Shares. Especially since US healthcare spending is expected to reach $6trn by 2027.